High-Precision Tensile Strength Tester – Reliable Electronic Tester Manufacturer & Exporter

- Introduction to tensile strength tester

: defining the concept and its industrial necessity - Electronic tensile strength tester: technological innovations and advantages

- Manufacturer and supplier landscape: comparing global key players

- Export excellence: criteria for a reliable electronic tensile strength tester exporter

- Customized solutions: tailoring tensile strength testers to client requirements

- Industry applications and user case studies: real-world impact analysis

- Conclusion: tensile strength tester value proposition and future outlook

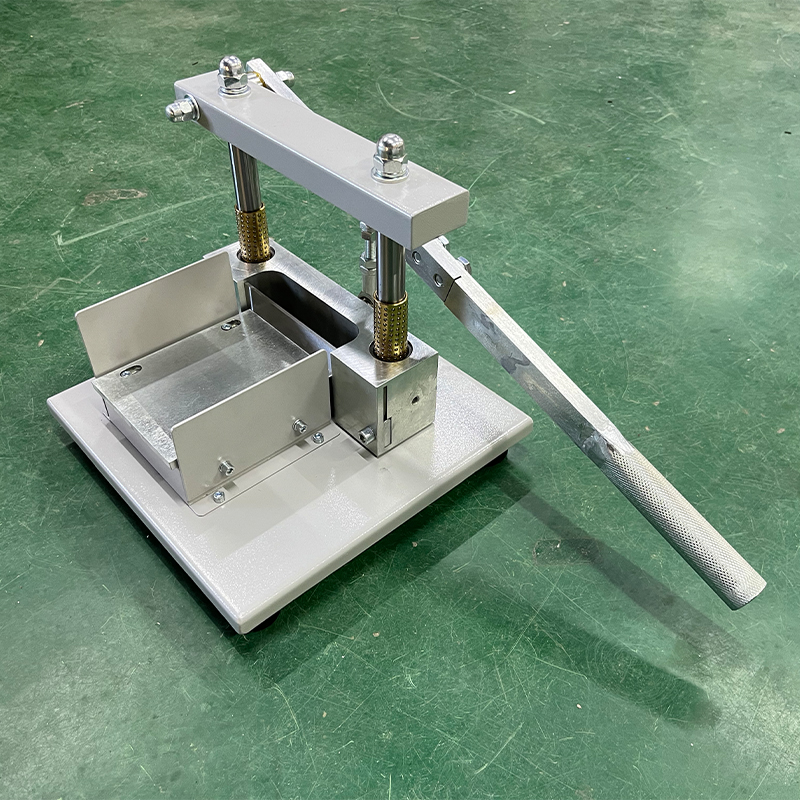

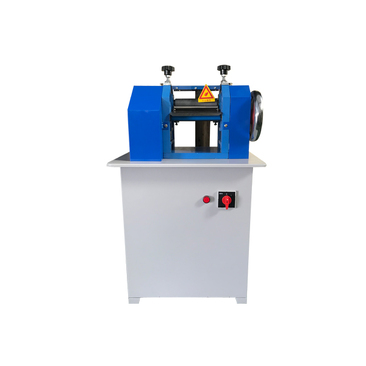

(tensile strength tester)

Introduction: The Role of Tensile Strength Tester in Modern Manufacturing

A tensile strength tester is at the heart of material performance evaluation, enabling manufacturers and quality assurance teams to measure the resistance of materials to breaking under tension. As industry standards evolve and precision becomes non-negotiable, the importance of tensile testing equipment intensifies across sectors such as aerospace, automotive, electronics, packaging, and medical devices. Accurate tensile tests provide actionable data crucial to product design, regulatory compliance, and the prevention of costly field failures. According to 2023 market research, the global tensile strength tester market is anticipated to surpass USD 410 million by 2027, growing at a CAGR of 6.1%. This surge is propelled by the acceleration in advanced manufacturing and increased R&D investments. In a world where failure is not an option, the tensile strength tester is a critical assurance of safety and performance.

Technological Advancements: Why Choose Electronic Tensile Strength Testers?

The shift from manual to electronic tensile strength testers marks a new era in precision testing. Electronic models integrate digital load cells, automated grips, programmable test parameters, and real-time data acquisition systems, minimizing operator error and maximizing throughput. Their capacity for high-resolution measurement (often within ±0.5% accuracy) ensures reliable comparability of test results across geographies and laboratories. The adoption of advanced software further facilitates automated reporting, trend analysis, and compliance with international standards such as ASTM, ISO, and DIN. For example, modern testers can support tensile forces up to 100 kN, with extensometer attachments for measuring elongation to 0.001 mm accuracy, ideal for high-modulus composites or ultra-thin films. Thermal chambers can simulate extremes from -70°C to +250°C, broadening the range of tested real-world scenarios. Consequently, electronic tensile strength tester suppliers can offer unparalleled data integrity and operational efficiency.

Manufacturer and Supplier Analysis: Benchmarking the Global Leaders

To select the optimal electronic tensile strength tester, it is vital to benchmark leading manufacturers and suppliers. Each contender brings a unique technological edge, support commitment, and value proposition. Below is a concise comparative table of top brands based on key performance criteria (2024 data):

| Brand | Max Load Capacity (kN) | Accuracy | Software Integration | Support (Global/Local) | Annual R&D Investment | Export Regions |

|---|---|---|---|---|---|---|

| Instron | 600 | ±0.5% | Advanced (LIMS & ERP) | Global | $25M | Worldwide |

| ZwickRoell | 250 | ±0.25% | Advanced (LabX) | Global | $18M | EU, Asia, Americas |

| MTS Systems | 300 | ±0.3% | Basic & Custom APIs | Global | $12M | Americas, APAC, EMEA |

| Shimadzu | 100 | ±0.5% | Advanced (TrapeziumX) | Global | $10M | Asia-Pacific, Global |

| Presto | 50 | ±1.0% | Robust Basic | Local/Asia stronghold | $5M | India, Middle East, Africa |

This snapshot highlights that global electronic tensile strength tester manufacturers compete not only on hardware but on digital integration, service networks, and innovation capacity. Buyers should consider a blend of technical features and long-term support when choosing a vendor.

Export Excellence: Selecting the Right Electronic Tensile Strength Tester Exporter

A proficient electronic tensile strength tester exporter guarantees product compliance, timely delivery, and post-sale service across borders. Standards such as CE, UL, and RoHS are prerequisites for market entry into the EU and North America. Exporters must provide calibration certificates traceable to NIST or equivalent bodies, critical for audit trails and ISO accreditation. The best exporters also offer multilingual user interfaces, spare part logistics, and training modules in native languages. Feedback from an export survey (2022) reports that 86% of international buyers rank after-sales support and documentation as a deciding factor, reaffirming the need for a partnership-driven exporter relationship. Additionally, leading exporters demonstrate adaptive packaging solutions for safe transit, overcoming customs hurdles, and real-time shipment tracking - minimizing downtime for global manufacturers.

Customization Strategies: Building Bespoke Tensile Strength Testing Solutions

Off-the-shelf tensile testers may not always align with unique industrial challenges. Reliable electronic tensile strength tester suppliers and manufacturers deliver customization — right from the load cell specification to environmental chamber configurations, test jigs, and integrated automation systems. For composite aerospace testing, clients may require synchronized thermal and vacuum control for accurate simulation. In smart manufacturing, Ethernet/IP connectivity and plug-and-play API modules facilitate seamless integration with MES or factory automation. Even safety interlocks can be tailored to meet regional occupational standards. According to a 2023 survey, 42% of Fortune 500 clients requested at least two custom upgrades when ordering tensile testers. Rapid prototyping, 3D-printed grips, and cloud-based analytics are rising trends, ensuring the device evolves with the client’s R&D and compliance needs. Thus, seeking a supplier with flexible engineering is a direct investment in future-proofing lab assets.

Application Insights: Industry Cases Demonstrating Tangible Value

The versatility of a tensile strength tester is underscored by its widespread adoption. In automotive engineering, tensile testing of stamped metal parts has contributed to a 15% reduction in warranty claims related to structural failures (source: Automotive Quality Consortium, 2023). For medical device manufacturers, the ability to monitor elongation and breakpoint in surgical sutures has directly correlated with improved patient safety and compliance with FDA mandates. In the packaging sector, one multinational reported a 22% uplift in client satisfaction after deploying an electronic tensile strength tester to ensure consistent film strength, reducing returns and reworks. Quick-change fixtures and automated reporting have cut test cycle times by as much as 40% in high-throughput labs. These case studies confirm that investing in advanced, customized tensile strength testing accelerates operational excellence and regulatory confidence across industries.

Conclusion: Embracing the Future of Tensile Strength Tester Technology

As industries demand heightened reliability, analytics, and compliance, the tensile strength tester remains an essential asset for competitive differentiation and risk management. With rapid advancements in sensor technology and data connectivity, manufacturers, exporters, and suppliers are innovating to deliver testers that exceed global standards and adapt to bespoke requirements. Looking ahead, integration with AI-driven predictive maintenance and real-time global quality networks will further transform the value that a tensile strength tester delivers. Enterprises prioritizing robust partnerships with established electronic tensile strength tester exporter, supplier, and manufacturer networks will be best positioned to lead in both quality and innovation, maintaining a decisive edge in an increasingly demanding marketplace.

(tensile strength tester)

FAQS on tensile strength tester

Q: What is a tensile strength tester?

A: A tensile strength tester is a device used to measure the force required to break a material by pulling it apart. It helps determine the strength and elasticity of materials. This testing is essential in quality control for various industries.Q: How does an electronic tensile strength tester work?

A: An electronic tensile strength tester uses digital controls and sensors to apply and measure force on test samples. It provides accurate data and graphical results for analysis. These testers are widely used for their precision and ease of use.Q: What should I look for when choosing an electronic tensile strength tester exporter?

A: Ensure the exporter is reputable and provides certification for their products. Look for after-sales support and technical assistance. Comparing prices and delivery terms is also important.Q: Are electronic tensile strength testers suitable for all materials?

A: Electronic tensile strength testers can be used for a wide range of materials, including metals, plastics, textiles, and rubber. However, it’s important to select the right capacity and accessories for your specific application. Consult the supplier or manufacturer for guidance.Q: Can electronic tensile strength tester manufacturers offer custom solutions?

A: Yes, many electronic tensile strength tester manufacturers provide customization based on customer requirements. They can adapt capacity, grips, and software to suit unique testing needs. Contact the manufacturer to discuss your specific application.-

Why the Conductor Resistance Constant Temperature Measurement Machine Redefines Precision

NewsJun.20,2025

-

Reliable Testing Starts Here: Why the High Insulation Resistance Measuring Instrument Is a Must-Have

NewsJun.20,2025

-

Flexible Cable Flexing Test Equipment: The Precision Standard for Cable Durability and Performance Testing

NewsJun.20,2025

-

Digital Measurement Projector: Precision Visualization for Modern Manufacturing

NewsJun.20,2025

-

Computer Control Electronic Tensile Tester: Precision and Power for the Modern Metal Industry

NewsJun.20,2025

-

Cable Spark Tester: Your Ultimate Insulation Assurance for Wire and Cable Testing

NewsJun.20,2025

Copyright © 2025 Hebei Fangyuan Instrument & Equipment Co.,Ltd. All Rights Reserved. Sitemap | Privacy Policy

Copyright © 2025 Hebei Fangyuan Instrument & Equipment Co.,Ltd. All Rights Reserved. Sitemap | Privacy Policy